It was brazen in its execution. Ng obtained lucrative business for his employer by paying a dozen government officials in Malaysia and Abu Dhabi. It was obscene in its greed. Today’s verdict is a victory not only for the rule of law but for the people of Malaysia for whom the fund was supposed to help raising money for projects to develop their economy. The defendant and his cronies saw 1MDB not as an entity to do good for the people of Malaysia but as a piggy bank to enrich themselves with piles of money siphoned from the fund. … Greed is not good. Today’s verdict has delivered a powerful message to those who commit financial crimes motivated by greed. [U.S. Attorney Breon Peace]

There are several people not on trial with Roger Ng who are nonetheless damningly implicated by the guilty verdict against him in New York on Friday.

These include his seniors at Goldman Sachs and the other key beneficiaries of the 1MDB fraud in Abu Dhabi and Malaysia whom, in order to find Ng guilty, the jury have clearly concluded from the evidence to be co-conspirators.

Each have been named in court as having knowingly been bribed, if only indirectly, with huge sums of Malaysian public money. They may think their wealth and power will protect them to a greater or lesser degree, however their reputation cannot recover and more should be done to bring them and their type to book in the public interest.

Meanwhile, Ng deserves his verdict as anyone who has followed the evidence in this case can see.

Ng Was Guilty And Lied

Ng’s defence was that he was just a lowly guy being prosecuted while all the bigger fish swam free. However, he was also trying to convince a jury that he was moreover entirely innocent and unwitting and had no idea what his superior, the bank’s Southeast Asia boss Tim Leissner, was getting up to with Jho Low as they schemed to steal half up-front of the $6.5 billion raised by the Goldman Sachs bond issues raised for 1MDB.

The $35 million that flowed into Ng’s elderly mother in law’s accounts, managed secretly by his wife and himself, were merely his wife’s profits from a business enterprise with Leissner’s wife, the couple claimed.

Yet the evidence spoke otherwise, as prosecutors traced that cash back to money directly stolen from the 1MDB bond issue. The jurors concluded it was a bribe.

Leissner, who had already pleaded guilty after being arrested in 2018, acted as the star prosecution witness providing narrative, explanation and colour to the tale of criminal conspiracy and collusion which a stash of documents, emails, texts, recordings and travel records confirmed in every detail.

In return for his full disclosure, much of which involved humiliating and personal detail on his private life, Lessner hopes for a much lesser sentence in return, or maybe no sentence at all. We shall see. However, what Ng has learned is that you can be the fall guy and be found guilty at the same time, and he awaits what could well be a lengthy sentence.

Roger Ng’s defence was that Leissner was a proven liar who sought to place the blame on himself an innocent man. However, it proved a threadbare tale that crumbled in the face of overwhelming facts. Despite his attempts at destroying records the banker’s fingerprints, presence and willing collusion was demonstrated over every aspect of the Goldman Sachs relationship with Jho Low and its business with 1MDB, much of which Ng chose to hide from compliance teams from the bank and to keep off the formal channels of communication in order to allow deniability for all concerned.

He was the point man from the start and the local fixer with the inside track for the foreign bank trying to break into a new emerging market in the wake of the financial crash, which Goldman had done much to provoke. Formerly with Deutsche Bank, Ng had specialised in building high level political contacts to swing deals in a country where corruption was rife.

Deutsche Bank had been in a partnership with the Sarawak chief minister Taib Mahmud’s major private investment vehicle, Kenanga Investment House and Ng first met with Jho Low in Sarawak in 2008 shortly after Leissner poached him to Goldman Sachs where the pair tested their first off-shore bond issue in Malaysia, the so-called Equisar fund by which Taib Mahmud raised billions for his controversial and destructive SCORE hydropower project.

Jho Low had himself just bought into a 50% share of another Taib family conglomerate UBG and boasted, as ever, of his key contacts with sovereign wealth fund investors in the Middle East. Having learnt Jho was known to be close to the Taib family and also to then deputy prime minister Najib and his wife Rosmah and to the Sultan of Terengganu, then serving as King, Ng promoted him as a valuable contact for the bank.

He introduced Jho to his boss Tim Leissner in January 2009 and all the evidence shows that the two men then persistently cultivated Jho and his contacts for the opportunities to do business with the Malaysian government over the coming years. Communication trails produced by the prosecution demonstrate that it was Ng as the local networking specialist who acted as the key contact with Jho and conduit for information (using personal rather than business emails in contravention of banking policy to hide his relationship).

He joined Low on a gambling trip to Las Vegas and formed a secret email account between the two men, later joined by Leissner and other insiders on their deals.

As the understanding and criminal relationship developed between these men, Ng attended all the key meetings where the conspiracy was developed whereby Goldman would raise billions through three bond issues on behalf of 1MDB and then siphon off the money. He was likewise plugged into all the key email exchanges involved in the conspiracy, although he later sought to erase these, the US prosecutors managed to obtain that information.

It was Ng who built the initial favoured status between Goldman and Jho Low who then promoted the bank to funds he was advising. The first was the original Terengganu Investment Authority (TIA) a project pitched by Jho Low and supported by Najib for investing the state’s oil revenues. The fund was chaired by the King and advised by himself. On the board was the King’s sister whose husband was also known to Jho Low – she sat on the board of the authority and was also connected to Low’s interests in Sarawak as a purported investor in Jho’s ADKMIC consortium that had bought into UBG (also as a board member of Low & Low, a construction company purchased as a subsidiary).

Jho Low promoted Goldman Sachs to be the investment banking advisor to Tia making plain to the bankers that they owed their selection to his favour. Goldman made a modest fee advising on an initial local bond issue by TIA through AmBank raising one billion dollars that would by July 2009 be absorbed into the remodelled 1MDB fund under Najib’s Ministry of Finance, after the sultan and his state government decided to cut loose from an enterprise that was being controlled by Najib and his proxy.

The first scheme to use 1MDB as a vehicle for plundering public money involved the theft of that original billion dollars through a bogus joint venture investment with a front company identified by Jho Low named PetroSaudi. Although taken on as advisors to 1MDB the Goldman bankers played little part in this stage of the relationship in that the target billion dollars was already sitting in the fund.

According to evidence cited by the prosecution Leissner and his colleagues had first been given to understand they might play a role in a joint venture using this money with Saudi Arabia’s major petroleum company but it then emerged the proposed partner was to be the unknown PetroSaudi Ltd, allegedly connected to the King of Saudi Arabia by virtue of his son, Prince Turki, a 50% shareholder.

It is now well known that Jho Low met with Najib, Rosmah and the two shareholders of the company Prince Turki and Tarek Obaid on a yacht off Monaco in August 2009 to agree the scheme by which they would in the course of the next eight weeks use PetroSaudi as a front to steal that billion dollars which had been transferred to 1MDB.

As efforts were later made to devise a cover up, emails from 2011 involving Ng discussed foisting the company on Petronas to disguise its losses. Jho had explained to his Goldman Sachs co-conspirators “We need to pay Omar so that he plays ball”. This, said the New York prosecutors referred to Omar Mustafa who had join the board of Petronas as a known crony of Najib’s. In fact, Petronas was not prevailed upon to buy out the PetroSaudi JV, however the Goldman bankers had shown willing to participate in a scheme that involved paying a bribe, which set the scene.

Throughout 2011, contacts show that as Jho Low built his business with the key sovereign wealth fund managers in Abu Dhabi, Ng nurtured the relationship on behalf of Goldman Sachs to explore potential lucrative business with the Malaysian government. And he kept Leissner in touch with the process. When Low acting as Najib’s acknowledged proxy at 1MDB suggested the prospect of raising a bond issue to invest in a major investment acquisition, Leissner suggested the Tanjong Power generating assets owned by one of his other wealthy clients Ananda Krishnan.

This was in January 2012 and prosectors demonstrated how what Leissner described in court as a ‘Scheme’ to extract much of the money was hatched with lightening speed over the next four months.

Far from being kept in the dark Ng attended all of the four key meetings that pulled together the scam, dubbed Project Magnolia. The first meeting was in London February 28th 2012 at Jho Low’s Mayfair apartment involving the inside team from 1MDB and Goldman Sachs. Besides Jho Low, Roger Ng and Tim Leissner attended from Goldman Sachs, plus the 1MDB legal counsel, Jasmine Loo, and Investment Manager, Nik Faisal, both collaborators brought in by Jho.

It was revealed during the trial that it was at this meeting that Jho laid out the now notorious list of who would need to be bribed from Malaysia and Abu Dhabi to process the conspiracy. It included all of the attendees plus Najib and Rosmah and Sheikh Mansour the Chairman of IPIC as the foremost individuals who would have to be paid the most. Leissner informed the jury that Jho had explained that Mansour was one of the most powerful people in the world and that ‘he didn’t get out of bed for less than a hundred million dollars’.

Lower down the list were the two top officials at Aabar, a subsidiary of IPIC, Chairman Khadem Al Qubaisi (KAQ) and CEO Mohammed al Husseiny. Two key aides to Najib and key staff at 1MDB would also be bribed to facilitate matters. Then in a category of his own, Sheikh Otaiba Jho Low’s by then key business partner in Abu Dhabi, the current Ambassador to the United States. Jho had approached Otaiba back in 2007 when he was seeking sovereign wealth fund investment in Iskandar Malaysia and had been paying him substantial kickbacks ever since for bringing in Abu Dhabi money into related Malaysian deals. The Goldman Sachs bankers Ng and Leissner were told to their faces they would be paid over and above the rewards the lucrative business would bring and shortly after this, the court demonstrated, Ng and his wife would open the UBS account in the name of her mother that would receive that upcoming bribe.

Ng also joined Low and Leissner in Abu Dhabi a fortnight later for a further key meetings with the key Aabar/IPIC movers and shakers to seal their cooperation in the Scheme that had been devised to use Aabar as a bogus official front to siphon out the money in the same way that PetroSaudi had served on the previous occasion. Cementing the high level engagement in this ruse Jho presented a letter from Najib to be passed to the IPIC Chairman Sheikh Mansour to formally propose that the Abu Dhabi fund provide a ‘guarantee’ to support the bond.

For the third meeting Ng and Leissner flew to the US to again meet Jho at his newly acquired L’Ermitage Hotel in Los Angeles on March 25th to discuss the power station purchase from Ananda Krishnan, which was the alleged main purpose for the bond issue. Having agreed how this would be handled Leissner and Jho Low flew on to New York to meet Ananda Krishnan, whilst Ng returned to Asia.

On April 21st there was a final vital meeting between the same players in Singapore to rope in BSI bank, Jho Low’s personal bankers, who were needed to play a crucial role funnelling out of the money and distancing it from the immediate players.

The immediate payment for the bonds was due to be deposited by Goldman Sachs into an account opened by 1MDB’s new energy subsidiary, IMEL, at none other than IPIC’s own private Falcon Bank.

BSI was to be prevailed upon to open an account for the newly created bogus off-shore ‘subsidiary’ of Aabar/IPIC namely Aabar Investements BVI into which a fake ‘payment’ would then be paid on the false excuse that this formed part of the agreement with the Abu Dhabi fund to guarantee the bond. In fact, Aabar BVI was directly owned by the two officials KAQ and Mohd al Husseiny and was controlled by Jho Low.

Jho Low, Ng and Leissner first met in one room of the restaurant while Jho’s personal bankers were waiting in another room, after which the two Goldman Sachs bankers proceeded on their own to meet with the BSI bankers who had been led to expect by Jho Low (as one Kevin Swampillae testified to the court) that they would receive a presentation on the offering by Goldman Sachs to reassure them as to their role as the chosen bankers for Aabar to receive the payment.

The BSI bankers, who clearly realised they had been selected owing to their relationship with Jho Low who was secretly managing the deal for Najib and 1MDB, however they received little information from the Goldman representatives. They questioned why the sovereign fund had chosen an off-shore vehicle to receive what they had been told would be a ‘guarantee payment’ of $571 million rather receiving it directly?

Far from reassuring these secondary bankers that Goldman Sachs had full oversight of the deal, Leissner told them that BSI should take responsibility for its own due diligence on such matters and then left abruptly. Ng remained but would not discuss the matter. BSI nonetheless opened the account.

Ng Was Centre Stage Of The Heist

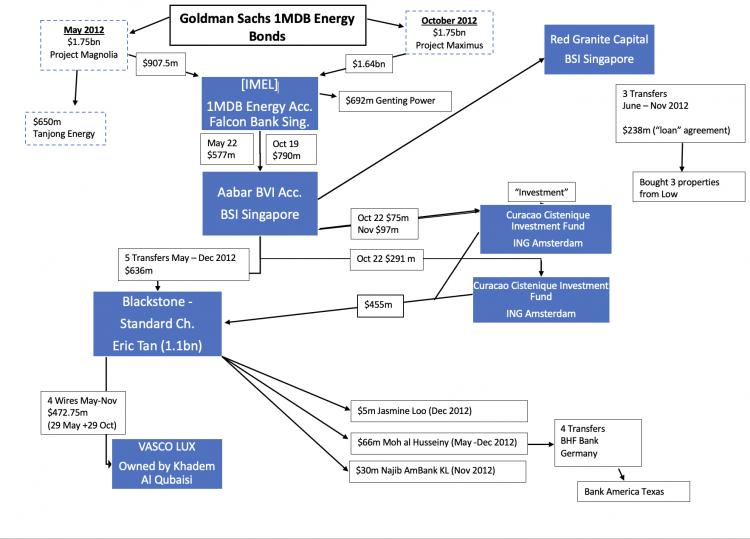

It was just one month later on 21st May that the bond money was raised directly from Goldman Sachs, who took a staggering $200 million in fees (amounting to 11%) and then swiftly moved through the stages of the Scheme that were designed to siphoned over a third of the money within hours of the deal being signed.

The power purchase heists – Project Magnolia (May 2012) and Project Maximus (October 2012)

In short, $650 million was signed over as an inflated payment to Ananda Krishnan for Tanjong Energy and the remaining $907.5 million was ploughed into an account set up for 1MDB’s new energy subsidiary IMEL at the Singapore branch of Falcon Bank that was owned by Aabar/IPIC, the partner in the deal.

Within 24 hours $577 million of that payment to IMEL’s Falcon Bank account had been shunted on to the BSI account belonging to the fake off-shore Aabar BVI subsidiary, owned by the two Abu Dhabi managers with a controlling signature from Jho Low.

From that point the money had been stolen and no trace of it was ever mentioned as having been received by Aabar/IPIC as a payment for a guarantee in any of their accounts. 1MDB, on the other hand, referred to the payment in its own belated accounts as a ‘repayable deposit’ made to secure the ‘guarantee’ on the bond and categorised it as an asset belonging to the fund. Except the money had been spirited away.

The Aabar BVI account then proceeded, at the behest of Jho Low, to send out funds to pay off the list conspirators cited at the very first meeting in London in February as needing to be paid.

So successful did Jho Low and his co-conspirators regard this exercise to have been, Leissner testified, that within two months they had set in motion a ‘cut and paste’ repeat exercise using exactly the same scheme and players. This was the second ‘power purchase’ bond issue raced through by 21st October, dubbed Project Maximus, this time of a Genting plant also in Malaysia.

This second bond was raised, even though officially there was still plenty of money left from the original bond to buy the Genting plant. After all, the bogus ‘guarantee payment’ had not been cited in the official bond offering circulated by Goldman and had not been paid to IPIC. Instead, the fund had formally only been offered buy-out options in return for the bond guarantee.

Over a billion dollars would eventually be funnelled from Aabar BVI into a Jho Low shell company account at Standard Chartered Bank in Singapore in the name of Blackstone Asia Real Estate Partners Limited BVI (BARPL) that was nominally owned by his close partner Eric Tan.

Another massive payment of $238 million was also shunted direct from Aabar BVI over three transfers to the Red Granite Capital film production company owned by Najib’s stepson, Riza Aziz, in California, which Riza utilised to buy three properties earlier procured by Jho Low and to fund movies. He would later claim the money was a gift from Al Husseiny.

Various round-tripping and layering excercises were undertaken to attempt to disguise the origin of the funding, including the use of two Curacao based off-shore ‘investment funds’ that were in fact merely pass-through vehicles that ‘invested’ the money sent to them by Aabar immediately back into Jho’s Blackstone company and later others set up for the same purpose.

Blackstone also eventually sent a payments totalling $88 million to Tim Leissner’s own off-shore vehicle Capital Place from which Leissner’s wife then forwarded Ng’s $35 million bribe to Roger Ng’s mother in law’s account.

The jury in the New York trial swiftly came to a decision that the evidence produced by the prosecution proved beyond reasonable doubt that this payment was in fact Ng’s pre-arranged bribe for his role in the theft. The evidence was indeed compelling and Ng deserves his guilty verdict having been a key culpable conspirator from the very inception of the bank’s relationship with Jho Low till the completion of the heists for which he was handsomely rewarded with stolen money.

As 1MDB watchers know these original power purchase bond heists were equally swiftly followed by yet a third ‘cut and paste’ operation that yet again adapted the exact same scheme with a few adjustments for a double the money $3 billion bond, Project Catalyze, which was allegedly designed to fund a proposed new business district in KL. The project was promoted in tandem as a joint ‘government to government’ venture with Aabar once more, and the same players from the Abu Dhabi fund flew this time to KL in March 2013 for a fanfare signing.

‘Cut and Paste’ – Project Catalyze

This time it was the government of Malaysia that signed a letter of support and again only 1MDB raised any money for the ‘co-investment’. Goldman issued the bonds even though the prospectus for the deal showed zero project development had been undertaken, despite the crashing hurry with which the bonds were once again raised in March 2013 less than a year after Project Magnolia. The reason being that Najib wanted the money for his election war chest in KL and was due to announce the dissolution of parliament in a couple of weeks.

Catalyze used the same players, banks and Curacao off-shore ‘investment’/pass-through funds in somewhat different configurations to steal an even greater proportion of the funds than before – paying Goldman Sachs a total of over $600 million in fees by the end of the three bond deals.

A total of over $4.5 billion would be stolen over the four stages of the thefts from 1MDB and it appears that right until the final moments as the scandal started to leak out, thanks to reports in Sarawak Report, the end game planned by the Goldman Sachs bankers was to cover-up the whole gaping theft by utilising Najib’s powerful control of the Malaysian economy and its major investment funds to secure a flotation of the now worthless fund.

Najib as Finance Minister cum Prime Minister would dragoon public savings bodies to buy into – thereby foisting the repayment of the vast debts created by this theft onto pensioners and savers, members of the public. He had also toyed with forcing Petronas to buy out the plundered, debt laden fund.

Roger Ng deserves his sentence and so does Leissner, but who else is culpable but yet to be brought to book?

Big And Bad – The Bosses At Goldman Sachs

The New York trial laid bare not only the direct conspirators in this scandal who were directly paid bribes, namely Najib Razak and his family, the Aabar fund managers, Jho Low’s crew at 1MDB and Ng and Leissner from Goldman Sachs, but the indirect conspirators who also profited to the tune of hundreds of millions.

Leissner named the senior figures at Goldman Sachs, his immediate superiors, who knew that he and Ng were consistently lying to the compliance departments of the bank that Jho Low was not involved in the 1MDB bond issues when he in fact orchestrated them from start to finish. These included Andrea Vella a senior partner for the bank in Asia who condoned these lies.

Jho Low had been identified since the PetroSaudi heist in 2009 as a Red Flag figure for the bank, being an ostentatious spender of unexplained wealth with clear political connections. Any dealings with him entailed reputational risk and likely involvement in corruption and had been vetoed by the bank.

However, immediately after these concerns were raised the top CEO of the bank, Lloyd Blankfein, agreed to meet with Najib together with Jho Low in New York in November 2009 in an encounter designed to kickstart the relationship with Malaysia at the highest level on both sides.

Following that encounter Jho Low’s reputation went from bad to worse in the banking world, and the Goldman due diligence teams rejected him as a wealth management client at least three times. Yet just weeks after the completion of the second bond heist in December 2012 it has emerged that Blankfein agreed to meet with Jho Low again, this time at his bank’s headquarters in New York and in the company of none other than the CEO of Aabar, Mohammed Husseiny.

The 1MDB/Aabar bond deals produced the biggest single windfall profits in Goldman Sachs’ history, over $600 million that resulted in record bonus payments for all the top partners in the firm, especially Blankfein and the present CEO who succeeded him, David Solomon.

Leissner and Ng chose to lie about Jho Low’s involvement to their compliance teams at the bank, and Vella and other Asia bosses were complicit through their silence in reporting what they knew. However, the rumours about Jho Low’s involvement in 1MDB were abundant at the time and the suspicious nature of the 1MDB bonds were there for all to see.

Anyone could see that the highly unusual structure of the joint guarantee, the rushed effort to raise huge sums of money in just a matter of a few weeks for largely unspecified reasons and then the repeated copy-cat deals that were equally rushed through with no good apparent reason for needing so much money in so short a time was suspicious.

The willingness to pay the crony bankers from Goldman Sachs a vast, unheard of level of commissions having been offered exclusive access to the deals without competition again spelt fraud.

Litigation against Goldman Sachs by angry shareholders who have been landed with fines thanks to 1MDB has cited that the bank’s most senior Asia boss and several other figures at the bank had sought to veto the bond deals on these very grounds. Instead of heeding such concerns, the top decision makers at the bank parachuted a new appointee over the Asia bosses head and sanctioned the bonds to go ahead.

Thanks to Leissner’s lies and Vella’s silence the bank’s ‘investigation’ and ‘compliance’ departments were able to tick the boxes on these glaringly suspicious deals, based only on a decision to assume they were receiving ‘honest answers’ instead of investigating a suspicious situation further.

Post-transaction monitoring, which the bank purported to have in place, would have soon traced the troubling diversion of hundreds of millions from each bond issue within 24 hours of the money being delivered on the pretence of paying for a guarantee that was not referred to in the offer document to a bogus off-shore subsidiary that was not in fact owned by Aabar at all.

Indeed, genuine multi-billion dollar global transactions involve months of preparation and huge volumes of legal documentation and hours of management input from all sides. By contrast, any Goldman Sachs banker would have recognised the 1MDB bond issues as a superficial farce – played out for show on behalf of powerful corrupt political leaders seeking to steal from their own public funds.

The ‘due diligence’ exercise by Goldman Sachs was therefore itself merely a farce where the most senior bankers in the company were willing to accept obvious lies from more junior partners such as Leissner, who was groomed on what and what not to say by his more senior intermediaries such as Andrea Vella.

Goldman Sachs’ conduct in this affair was based on one cynical calculation about a distant foreign country where their intelligence proved wrong. The bankers judged that Najib’s iron grip on the country as the prime minister of a party that had retained power for over 60 years would not be shaken and therefore the crime would go unspoken and unpunished.

They assumed that Najib could continue to steal blatantly and with impunity as the ruler of a sham democracy where he would be able to rig the next election and cover up his crimes by floating 1MDB – naturally with the lucrative assistance of Goldman Sachs.

This is borne out by the way the bank reacted after Sarawak Report first exposed the early thefts involving Jho Low at 1MDB. Instead of immediately re-opening their investigations into their own role in the affair Goldman Sachs, like Najib, pretended there had been no wrongdoing whatsoever.

When Leissner was eventually forced out the public reason given was for a minor conduct breach and not the suspected theft of billions through the bank. Only years later, after Leissner was arrested and pleaded guilty, did Goldman Sachs begin to admit that owing to this ‘rogue’ individual there had been misbehaviour by the bank.

In short, everyone at senior level at Goldman Sachs had to have realised from the very outset that the 1MDB bond deals were corrupt, however each of them was indirectly bribed by the millions they made in bonuses from the record fees they made and by the promise of future lucrative government business in Malaysia.

– Sheikh Otaiba And The Abu Dhabi Royals

Also untouched is the Abu Dhabi Ambassador to America, Sheikh Otaiba, who financed a $50 million Malibu mansion from his hauls from 1MDB. Otaiba has poured Gulf money into influence buying in America and making himself a powerful figure. Despite the multiple references to kickbacks to Otaiba made in this trial and elsewhere no action has been taken against him in Abu Dhabi or Malaysia.

Also swimming free are the royal rulers cum sovereign wealth fund bosses of Abu Dhabi, who blatantly agreed to support the show of bogus ‘joint ventures’ with Malaysia in return for kickbacks paid to underlings who are now being punished. Both KAQ and al Husseiny were arrested and imprisoned in Abu Dhabi shortly after their scandalous conduct also leaked via Sarawak Report in March 2015. However, it was Sheikh Mansour who personally authorised the role played by Aabar/IPIC in the official bond offer and just as Jho Low had said he would need to be paid, at least $160 million of the half billion in kickbacks to a KAQ account in Luxembourg was spent on funding the purchase of Sheikh Mansour’s TOPAZ yacht.

It was Mansour’s brother, the Crown Prince MBZ of Abu Dhabi himself, who came to KL to launch the so-called joint investment between 1MDB and Aabar which fronted the final bond theft. When the scandal exploded and Najib called MBZ to warn that both Riza and Mansour were exposed, MBZ collaborated in a new cover-up to rescue Najib and bail out 1MDB in the short term, in return an agreement by Najib to fund a punishing multi-billion dollar arbitration settlement again at the expense of the Malaysian people.

– Jho And His Gang

Jho Low, his family and criminal gang of collaborators whom he brought in to 1MDB to manage the thefts in key official roles (Jasmine Loo, Terence Geh, Nik Faisal, Casey Tang, Vincent Koh and others) all realised from the moment of the first 1MDB expose in February 2015 that their time was up. They fled and remain fugitives together, believed to be living free in China thanks to China’s own compromised position after assisting Najib and Jho Low in their attempted cover-ups.

– Najib

Four years after being turfed out of office by a furious electorate, Najib Razak and his greedy wife (who received half a billion dollars of jewellery funded by the thefts) have taken far longer than Roger Ng to be brought to book through the KL courts for the far greater crime of authorising and pushing through the relentless series of heists signed off each time by Najib’s own hand.

Jho Low was Najib’s proxy; Najib abused his over centralised position of power in Malaysia to obtain the lion’s share of the heist for his family. He then abused his power again to deny and cover-up the scandal, stealing more billions in his attempts to do so.

Although he has been confirmed guilty of one local set of 1MDB-related crimes by the Appeal Court this scandalous ex-prime minister has continued to marshal all his money and connections to delay the bulk of his trial, slow down his appeal against his convictions and to create on-going political havoc in a blatant bid to destabilise the country. All this in the selfish hope of avoiding jail and snatching back power instead.

His manoeuvrings were behind the coup that overturned the elected government and his incoming political allies moved swiftly to drop the prosecution against his stepson Riza, who has trousered hundreds of millions from the heist and made fat profits from 1MDB funded movies.

Crime has been proven not to pay for many involved in 1MDB, yet the biggest criminals, those with a responsibility to lead, remain the least punished so far.