Apple has previously been accused of being a monopoly when it came to in-app payment solutions. This was a major part of the legal battle between the iPhone maker and Epic Games, the company behind Fortnite. Though now, it looks like debit and credit card issuers in the US also have a legal bone to pick with the fruit company, and along similar grounds too.

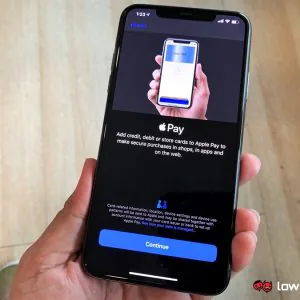

The Verge reports that Iowa-based Affinity Credit Union has filed a lawsuit against the company, specifically its Apple Pay feature. The card issuer’s lawyers are also hoping to extend it into a class-action lawsuit so that other card issues can join in.

At the core of the complaint is that Apple charges credit card companies up to 0.15% per transaction in Apple Pay fees. While this looks to be a small amount, the suit claims that the iPhone maker makes over US$1 billion (~RM4.46 billion) this way. At the same time, the card issuers don’t have to pay such fees when their customers user “functionally identical Android wallets”.

The lawsuit alleges that the iPhone maker is violating antitrust law by making Apple Pay the only service that can carry out NFC payments on its devices. This includes iPhones, iPads and even Apple Watches. Because of this, the lawsuit also claims that this prevents card issuers from passing on the aforementioned fees to consumers, giving them no incentive to find other payment methods that may be cheaper.

Much like the Epic Games and Apple lawsuit, whether or not something is a monopoly is heavily reliant on definition and interpretation. In this one, the plaintiffs say that the company has a monopoly on “tap and Pay iOS mobile wallets”. Whether or not the presiding judge agrees with the definition, or if it is indeed a monopoly, remains to be seen.

(Source: Businesswire via The Verge)

The post US Card Issuer Sues Apple For Monopoly Over Apple Pay appeared first on Lowyat.NET.