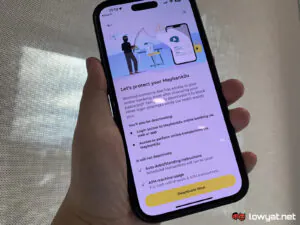

Malaysian banks have recently started rolling out a kill switch feature to beef up banking security for customers and the latest bank to do so is Maybank. Its switch is specifically for the online Maybank2u platform, allowing customers to deactivate access to their account if they suspect that it has been compromised to protect their funds.

Oddly enough, the new kill switch feature can only be used on the MAE app or the desktop Maybank2u website, leaving out the main M2U app. Once access to Maybank2u has been deactivated, you will automatically be logged out from all active sessions on the MAE app, M2U MY app, and Maybank2u web, blocking any login attempts.

To activate the new security feature on the MAE app, open the Maybank2u tab and tap on the three dots in the top right corner to find the “Kill Switch” button. From there, you’ll need to enter your M2U password and tap on “Deactivate M2U Access”.

On the Maybank2u website, you need to go into your settings after logging in, click on security, and then choose kill switch. You can then proceed to deactivate access to the service.

Deactivating Maybank2u access will mean that you won’t be able to log in via web or app and you won’t be able to perform online transactions. However, even after activating the kill switch, you will still be able to withdraw cash from ATMs and use your debit and credit cards, including through mobile services such as Apple Pay and Samsung Pay. Scheduled transactions like auto-debit will also run as usual.

After you have secured your account, you can reactivate access to the online service by calling Maybank’s customer care hotline at 1-300-88-6688 or visit any Maybank branch. Other banks that have introduced a kill switch feature include CIMB and OCBC, although the latter only allows it to be activated via phone call.

(Source: Maybank)

The post Maybank Launches Own Kill Switch For Maybank2u appeared first on Lowyat.NET.